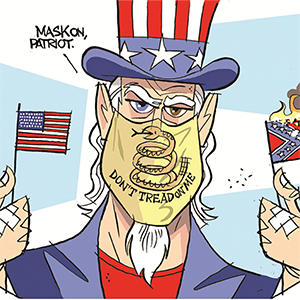

May Fed meeting preview: Are rate cuts canceled or just delayed? Watch for these 3 key themes as inflation stays hot

Published in Business News

At the start of the year, the nation’s top economists thought the Federal Reserve would be using its May rate announcement to tee up the first cut of its fiercest inflation-fighting regime in 40 years.

Now, as inflation stays more stubborn than expected, they’re wondering whether those cuts are delayed — or completely canceled.

It’s been a tough three months for the inflation-focused Federal Open Market Committee (FOMC). At the end of 2023, a rare combination of slowing inflation and resilient hiring made the illusive “soft landing” of the U.S. economy appear in reach. The latest data, however, shows that consumer prices have been topping expectations again, even as growth in the first three months of 2024 slows more than expected.

Inflation is on pace to hit 4.5% by March 2025 if the trends of the past three months continue for a full year, thanks to a pop in energy prices as well as elevated shelter, medical care and insurance costs, Bureau of Labor Statistics data shows. That’s more than double the Fed’s official 2% target and up from a 1.9% three-month annualized pace just four months ago.

Those reports foreshadowed similar setbacks in the Fed’s preferred inflation gauge from the Department of Commerce. Excluding food and energy, those prices topped a 3.7% annualized rate in the first quarter of 2024, after two straight quarters of it matching the Fed’s 2% target.

Policymakers currently have no reason to move rates in either direction, as employers’ historic hiring spree keeps unemployment below 4% for the longest stretch of time since the 1960s. But for consumers, the message remains clear: Financing rates on loans from mortgages to credit cards are likely to stay high — a price U.S. central bankers consider worth paying to defeat inflation.

1. Economists say the bar for a rate cut is still higher than a rate hike

With nothing but bad news on the inflation front lately, both economists and investors have started to doubt whether the Fed will be able to justify the three rate cuts that officials were projecting as recently as March. Whispers of the Fed debating whether to raise interest rates again have even started growing.

“It may not be able to cut at all in 2024,” wrote Diane Swonk, chief economist at KPMG, in a note after a Commerce Department report that showed growth slowing and inflation jumping more than expected. “Some participants at the May Fed meeting are likely to raise discussion about the possibility of rate hikes.”

No matter what, officials will let the data do the talking, and the U.S. economy could evolve differently by the Fed’s September meeting, the soonest Fed officials might now cut rates, according to most of the economists who are still projecting them.

...continued

©2024 Bankrate.com. Distributed by Tribune Content Agency, LLC.

Comments